That means spring forward

change the batteries on the smoke detectors

and

— BACKUP YOUR DATA —

Backing up your data is like flossing your teeth.

You don’t have to floss them all

just the ones you want to keep.

SEATTLE – Usually signs are in the business of letting potential—and current—customers know about sales, special events and other information related to the company. Most convenience stores use outdoor signage to highlight specials and products, but the Wallingford Chevron gasoline station and convenience store has taken a different tack: humor.

For more than a decade, this station’s sign has posted amusing sayings to the delight of customers and residents. The genesis of the humorous postings is traced back to when the owners replaced an auto repair shop with a convenience store. To get the word out about the change, the owners hit on the idea of entertaining signage, the News Republic reports.

Popular messages include:

The station has a dedicated Facebook page for the Wallingford Sign with photos of its most popular ones.

Full article found here:

NEW YORK – Avi Kaner, a co-owner of the Morton Williams supermarket chain in New York, has spent about $700,000 to update the payment terminals at his stores to accept EMV chip cards. However, he can’t turn them on, writes The New York Times, a bottleneck in offering a more secure payment process that is frustrating retailers—both large and small—across the United States.

Since the EMV liability shift took place on October 1, 2015, retailers have been essentially put on hold to get their payment terminals certified to accept chip cards.

The Times reports the cost of waiting is piling up. “It’s been very frustrating,” Kaner told the news source, noting that he purchased most of the upgraded POS equipment before the Oct. 1 deadline, and he’s still waiting for certification. The delay, he says, has cost him thousands of dollars in payments for fraudulent purchases. “There’s no recourse,” he said.

“The long delays are just the latest black eye for the deployment of the new systems,” writes the Times, noting that some consumers haven’t even received new credit and debit cards with the embedded EMV chip.

First Data, one of the largest payment processors, told the Times that about 20% of the four million American merchants it works with are in the process of being certified, a procedure than can take weeks to months.

Mallory Duncan, general counsel at the National Retail Federation, told the Times that the payments industry was unprepared to handle the flood of certification requests around the Oct. 1 liability shift deadline. “They didn’t allow for enough time or people to perform this certification,” he said. “Merchants have gotten slammed because they weren’t able to get certified, because the networks failed to provide the necessary resources to do that.”

Kaner commented that since Oct. 1, customers who have contested charges made with their EMV-enabled cards have been successful in reversing transactions, and he’s worried that some customers will use the Oct. 1 liability shift to get out of paying for legitimate purchases. Chargebacks, he said, have increased significantly. “It started out as a trickle, and now it’s turning into a flood,” he told the Times. “In the first couple months, it might have been a few hundred dollars a month. Now, it’s thousands a month.”

“The convenience and fuel channel has numerous retailers in the same situation, having invested upwards of $30,000 per site to be hardware-ready for EMV, only to be put on perpetual hold with approved software,” said Gray Taylor, executive director of Conexxus. “These retailers are trying to avoid the inevitable manufacturing and installation bottlenecks to do the right thing and get ahead of the curve, only to be on perpetual hold by an over-burdened vendor community trying to navigate late specifications and complex certifications. This is what happens when you simply choose a deadline, like the card brands did, without diligence. The premium retailers will pay for this ‘hurry up and wait’ situation and it will result in higher consumer prices.”

=====================================

Thanks NACS for this article. Retailers aren’t the only ones frustrated, resellers share equally in the frustration.

ALEXANDRIA, Va. – This week NACS told policymakers about industry concerns with a proposed rule published by the U.S. Department of Agriculture that includes problematic new eligibility standards for retailers participating in the Supplemental Nutrition Assistance Program (SNAP).

“The proposed [SNAP] rule would make tens of thousands of small businesses ineligible to participate in the Program. Small businesses will be harmed and SNAP beneficiaries, who rely on these small stores in both urban and rural environments, will lose options they need to feed their families,” wrote NACS in a letter to the chairman and ranking member of the House Appropriations Subcommittee on Agriculture, Rural Development, Food and Drug Administration and Related Agencies, and the chairman and ranking member of the House Agriculture Committee.

As previously reported by NACS, on February 17, the U.S. Department of Agriculture’s Food & Nutrition Service (FNS) published a proposed rule altering eligibility requirements for retailers participating in SNAP. While the proposal codifies the 2014 Farm Bill provisions, which NACS supported, it also makes other changes to retailer eligibility requirements that Congress never intended to address in the 2014 Farm Bill. The proposal would impede neighborhood retailers’ ability to participate in the program, which in turn would hinder food accessibility for SNAP recipients that use their benefits at these small format retail locations.

“It appears that FNS is trying to push small retailers out of the SNAP program altogether, for no sound public policy reason,” NACS wrote to Congress, adding that Food, Nutrition and Consumer Services Undersecretary Kevin Concannon recently testified before the House Appropriations Committee that there are more small stores participating in SNAP “than we really need.”

The USDA’s SNAP proposal codifies the 2014 Farm Bill “depth of stock” provisions, which require retailers to stock 7 varieties of products in each of the four “staple food” categories. Problematically, the proposal also includes several changes that were neither required nor envisioned by the 2014 Farm Bill.

The proposal redefines the term “staple foods” and limits the items that may count as staple foods for depth of stock determinations. Under the proposal, multiple ingredient items (e.g. soups or frozen dinners) would not count towards depth of stock requirements. The proposal also expands the definition of “accessory foods” to include foods consumed between meals, like snacks (e.g. hummus and pretzel packs).

Because accessory and multiple ingredient foods may not be counted as staple foods for depth of stock determinations—the proposal essentially narrows the universe of acceptable foods that a retailer can stock to participate in SNAP, ultimately raising the stocking numbers beyond the numbers established by Congress.

Next week in Washington during the NACS Government Relations Conference, industry stakeholders will be communicating to members of Congress and their staffs that convenience stores play a fundamental role in SNAP, particularly for low-income Americans who live in rural or urban environments. By making it increasingly difficult for small format retailers to participate in SNAP, the proposal would essentially punish SNAP beneficiaries by requiring them to travel outside of their local neighborhoods where larger format retailers may not exist.

A memorandum analyzing the proposal is available online exclusively for NACS members.

Published in CSP Daily News

DALLAS — Did you know that people buy chocolate with just about anything else in the store? That people have had $700 more in their accounts since last year? And that customers shop a convenience store in the evening the way they do a small grocery store?

In the session “Boosting the Convenience Market Basket” at CSP’s Convenience Retailing University, Don Burke, senior vice president of Management Science Associates Inc., Pittsburgh, analyzed data compiled from three convenience-store retailers and offered these tips:

By Abbey Lewis, Editor in Chief, Convenience Store Products , Feb. 2, 2016

Illustration by Jean Jullien

From behind the two-way mirror, we exchanged glances—we were perplexed, surprised, amazed. A colleague and I sat with our notebooks in the dark, prepared to hear a lot of things we already knew: Customers like variety, fresh food, clean bathrooms, etc. But when our two focus groups arrived at Product Evaluations Inc.’s offices in Oak Brook, Ill., we heard a lot of things we weren’t expecting. Did you know they don’t consider convenience stores and gas stations to be the same thing?

Product Evaluations, a foodservice market research company, usually focuses only on food. Its expertise is on your roller grill or coffee bar. But for us the company bent the rules, focusing the line of questioning on the forecourt, backcourt and new products—and, of course, foodservice.

When we began developing the questions, we realized this could be a unique opportunity to truly discern between millennial customers and all the others. So we broke them into two groups. The first group was made up mostly of Gen X shoppers, with some baby boomers. The second group was composed entirely of millennial customers.

It’s worth mentioning all panel participants are from the Chicago area, which is flush with 7-Eleven, Speedway, BP, Thorntons and independent locations. None of our participants had even heard of Wawa, much less Rutter’s, Kwik Trip or Stripes. (Maybe next year we’ll conduct a panel from Florida and see what they think …)

Read on to see the differences and surprising similarities among respondents—as well as actionable tips based on their feedback. And keep an eye out at CStoreProductsOnline.com to read some of the outtakes.

Q: What makes you loyal to a particular convenience store?

Liz (Household income <$25,000): I look for a rewards program. I have one that’s an app on your phone and you can get free coffees and different free things. … I know if I get something, I’m going to get something free next time. It’s easier on my wallet. 7-Eleven had free coffee for the entire week recently, so I was there a lot. I went out of my way to get to that.

Q: Who has used rewards cards? Does it make you more loyal to those brands?

Mary ($75,000-$99,999): Yeah, at Speedway if you say you don’t have [your card], half the time they’ll just scan a new one for you. They pass them out like candy.

Tom ($100,000 or more): Yeah, they have bonus points that you buy like, say you buy a Red Bull, you get a hundred more extra points or something like that [at Speedway].

David ($100,000 or more): You buy three pieces of pizza instead of two, you get a bunch of extra points …

Convenience Store Products: So do they “get you” on that?

David: Oh yeah, I’m a sucker for that.

Liz: When I go to get scratch-offs, I always go to the CITGO in Glenwood, Ill., because they have all the machines right next to each other. They also have an area where you can sit down and scratch them off. It’s much better than other places.

Q: What are you purchasing when you go to the convenience store?

Lorraine ($25,000-$39,000): When I go to a c-store … I might get some feminine products. I don’t want to necessarily go through the hassle of going to Wal-Mart, standing in line, going to search for it. The convenience store has got your drinks over here, you got your other stuff over here, you go, “OK, let me just grab it real quick and go.” The big stores, you have to deal with people, the crowd, and you got to really search. You ain’t got time for that.

Catherine ($100,000 or more): I usually just go there for drinks, like AriZona tea, or just a bag of chips and then go.

David ($100,000 or more): Beer, lottery tickets, scratch-offs—that’s probably it for that.

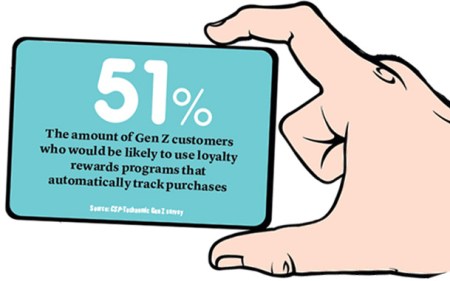

Mobile payment, souped-up loyalty programs, at-pump ordering, connected cooking equipment and more can greatly affect your foodservice program. According to an NCR study from earlier this year, 67% of restaurant owners and managers said that technology has a direct effect on increased revenue, and 35% are more dependent on tech tools than they were a year ago. Just remember to do your due diligence. Don’t invest in something your customers won’t use.

Q: How often do you go into the convenience store vs. just staying out at the pumps for gas?

Liz (Household income <$25,000): Most of the time I go inside.

Peter ($25,000-$39,000): I always go inside. When I’m not getting gas at Costco because it’s cheaper, whenever I stop at one of those stations, I always go inside. If I stop at one of those stations to get gas, it’s because I’m almost empty.

Jane ($40,000-$74,999): If I’m at the pump, and it’s at a convenience store, I always go in. Not that I need to go in. I don’t know why. I want to look at something. And I don’t pay at the pump.

Anne ($40,000-$74,999): Even with your credit card. Just go in. You just got to go in.

Convenience Store Products: You say you don’t ever pay at the pump?

Peter: I don’t because of security reasons. … I’ve heard so many things. I always go inside and pay, even if I want to swipe my card—I just don’t swipe it at the pump.

35%

The amount of gas customers who also go inside the store —2015 NACS Consumer Fuels Survey

Q: What piques your interest when you walk in a store? What will catch your eye?

Peter: Sometimes a display. What’s in front of your face—sometimes it’s a new product.

Anne: You know when you were a kid in a candy store, you see something at that display and you think, “Let’s go check that out.”

Peter: New Gatorade just came out. New flavors. Oh, that looks good. I’ll just take it.

Q: What makes convenience stores unique from other kinds of stores?

Catherine ($100,000 or more): No lines.

David ($100,000 or more): In and out—it’s quick.

Lorraine ($25,000-$39,000): Everything is conveniently placed, so it’s not a whole search through a maze. Most of the aisles are open, so that when you’re walking through diagonally, you can see most of the things as you’re going. The setup is more open than a regular store.

Tom ($100,000 or more): Everything is accessible—easy to find.

“I’ll be out at lunch, and I don’t want to be at work, so I’ll find the gas station, go in there, look around, take my time, find something to snack on, then go back to work.” —Liz (<$25,000)

New products matter! Work on developing your new-product strategy, but first strengthen Your core offer. Implement the proper analytics to measure your core products before investing in too many new-product tests. Of course, consistency could be the key—your customers are coming to you to find new products and will go to the same area or merchandiser to find them each time. Develop a plan and stick to it.

Q: How do you choose one store over the other?

Amanda (Household income $40,000-$74,999): I judge it on the size of the gas station. If I’m driving around or on a road trip, I’m going to hit the gas station that’s the biggest if I’m looking for snacks. I’m not going to go into, like, a little square shop …

Convenience Store Products: Why wouldn’t you go into the little place?

Amanda: Because then I feel like there’s less selection. If I’m going there specifically for food or whatever, I’m going to look for the biggest one. Even for a bathroom, I look for the biggest one because it means it won’t be outside.

Q: What do you buy at convenience stores?

Jenna: I remember when those Cheetos things came out, with all like the weird balls and everything, and I was like, oh my God, that’s going to be amazing. I was looking for them and I figured the gas stations would have it, so that’s when I was just knocking down the door. I finally found them.

57%

The amount of convenience stores (127,588 total) that sell motor fuels —NACSonline.com

Q: What does the size of the store mean to you?

Peter ($25,000-$39,000): The small ones—it’s too cramped in there. There’s too many people in there. And it’s not just the inside, but the outside also. When you’re pulling up to this huge place, where there’s 10, 12 pumps and a big parking lot … with good lights.

Jane ($40,000-$74,999): Yes, you want the good lighting. It would be a safety issue.

Jack ($100,000 or more): A cramped place doesn’t feel as safe.

Jane: I will bypass those [small stores]. I’ll go to a bigger one. I would definitely go there before I’d go to a smaller one—it’s just safer.

Patty ($40,000-$74,999): What they need is oatmeal. Everyone else has oatmeal. I want oatmeal. It would be perfect for a convenience store—definitely.

Surprisingly, both demographics differentiated between “gas stations” and “convenience stores.” To explain, Liz said, “I feel like the size is what distinguishes it. If it’s a really small building, then we feel like it’s just a gas station, nothing special. If it’s a bigger-size building and there’s more square footage, then it’s more of a convenience store.” Installing brighter lights and decluttering could go a long way toward attracting that new customer, boomers and millennials alike.

Q: What’s your favorite food to buy at convenience stores?

Lorraine (Household income $25,000-$39,000): Pizza. You’re not expecting to get a supreme pizza—like, it’s going to be your most basic pepperoni, sausage or cheese.

David ($100,000 or more): I’m one of the least pickiest eaters out there, so it’s like I’ll get a Speedy Dog, and just load it up with all the ingredients, and I’ll go to town and I will love it. I’ll get their pizza and I’ll love it. That’s just me.

3 in 4

The number of shoppers who say it’s important to feel good about the foods and beverages they consume —Technomic’s Consumer Trend Report

Q: Which foods belong in convenience stores, and which do not?

Convenience Store Products: OK, so you’ve indicated that these items don’t fit at all: deli salads; chicken, either fried, roasted or grilled; soup, chili, dispensed ice cream or frozen yogurt.

Jenna (<$25,000): Where are you cooking the chicken?

Convenience Store Products: What about ice cream, soup or chili?

Amanda ($40,000-$74,999): I haven’t seen those.

David: Yeah, me neither.

Catherine ($100,000 or more): I think it’d be hard to keep the frozen-yogurt machine clean, but I’d totally get it.

Q: How have your perceptions of convenience-store food changed?

David: Before, I always just assumed that it wasn’t good, that it wouldn’t taste good—I don’t know. … Once it became convenient to where I was working, and it was easy, convenient to get food there, I tried it. I said, “What the heck? Let’s do it.” And it tastes good. Let’s do it again.

Amanda ($40,000-$74,999): I feel exactly the same. I always thought it was just disgusting, and people might sneeze on it or something, but then it’s like, my guy would have me go pick up a pizza or something. Okay. And then I’m like, “Oh, it’s not that bad.” Then I ended up getting a few things for myself after that.

Tom ($100,000 or more): I felt like coffee was really bad at convenience stores, but I actually found out that at 7-Eleven, their coffee is much better than I thought.

“A large Slurpee from 7-Eleven—at 2 a.m., every time I was studying … we’d all go. It was awesome. And they go great with those little taquito things.” —Jenna

These customers have changed their view of the food in your stores. Believe it or not, as much as perception of c-store fare has improved, there are still opportunities to be had. And freshness is the key. According to Technomic, 76% of consumers say positive terms such as “natural flavors” are perceived as resulting in enhanced flavors. And shoppers are demanding more transparency in their food. Non-GMO-fed, verified fresh eggs, chicken, pork and even sausages from brands such as Fork in the Road will be worth watching. Try it. They might like it!

http://www.cstoreproductsonline.com/foodservice/opinion-consumer-perspective

Convenience stores offer speed of service to time-starved consumers who want to get in and out of the store quickly. These shoppers recognize this channel of trade for its convenient locations, extended hours of operation, one-stop shopping, grab-and-go foodservice, variety of merchandise and fast transactions.

The average convenience store is 2,744 square feet. New stores are bigger, with 3,590 square feet, with about 2,582 square feet of sales area and about 1,008 square feet of non-sales area — a nod to retailers recognizing the importance of creating destinations within the store that require additional space — whether coffee islands, foodservice areas with seating or financial services kiosks. Convenience stores also have expanded their offerings over the last few years, with stores become part supermarket, restaurant, gas station and even a bank or drugstore. (NACS State of the Industry data)

The convenience store industry is America’s primary source for fuel. Overall, 83.5% of convenience stores (127,588 total) sell motor fuels, a .7% increase (960 stores) over 2013. The growth of convenience stores selling motor fuels is nearly double the overall growth in the industry, as fuels retailers added convenience operations and convenience retailers added fueling operations.

Convenience stores have an unmatched speed of transaction: The average time it takes a customer to walk in, purchase an item and depart is between 3 to 4 minutes. Here’s the breakdown: 35 seconds to walk from the car to the store, 71 seconds to select item(s), 42 seconds to wait in line to pay, 21 seconds to pay and 44 seconds to leave store. (NACS Speed Metrics Research, 2002)

The convenience store industry is a destination for food and refreshments. With falling revenues from fuels and tobacco products, foodservice sales are increasingly becoming convenience stores’ most profitable category. In fact, convenience store foodservice is roughly a $41 billion industry contributing 19.4% to in-store sales in 2014 (NACS State of the Industry Report of 2014 Data).

Convenience stores are everywhere. There are 152,794 convenience stores in the United States — one per every 2,095 people. Other competing channels have far fewer stores, such as supermarkets (41,529 stores), drugstores (41,799 stores), and dollar stores (26,572). (Source: Nielsen, as of December 31, 2014)

Consumers are embracing convenience stores like never before. An average store selling fuel has around 1,100 customers per day, or more than 400,000 per year. Cumulatively, the U.S. convenience store industry alone serves nearly 160 million customers per day, and 58 billion customers every year.

Self-serve at the pump is a part of most convenience stores’ fueling operations. The first self-serve gas station was opened by Hoosier Petroleum Co. in 1930, but was closed by the fire marshal as being a fire hazard. Frank Ulrich reintroduced the idea in 1947 at the corner of Jilson and Atlantic in Los Angeles. Modern self-service began in 1964 with the introduction of remote fueling; an attendant was no longer required to reset the pumps after each transaction. Today it is now available in 48 states. (New Jersey and Oregon still require full-service operations; New Jersey’s law was enacted in 1949; Oregon’s in 1951.)

http://www.nacsonline.com/Research/FactSheets/scopeofindustry/pages/convenience.aspx

LA CROSSE, Wisc. – The Partnership for a Healthier America (PHA), which works with the private sector and its Honorary Chair First Lady Michelle Obama to make healthier choices easier, is recognizing Kwik Trip as the first convenience store to complete its commitment to expand healthier options across its stores.

“With more consumers expecting to find fresh and healthy items on the go, the convenience store industry is in the midst of a momentous shift, one that Kwik Trip has been leading for several years now,” said PHA CEO Lawrence A. Soler. “Just a few years ago it was unusual to see fresh fruit in many convenience stores, but today, Kwik Trip sells 400 pounds of bananas per store per day. In fact, after making a commitment to PHA, Kwik Trip’s bulk produce sales grew 5.5% in 2015.”

Since first teaming up with PHA in 2014, Kwik Trip has fulfilled its initial commitment to PHA by:

In addition, through its EatSmart program, designed to encourage healthier options, Kwik Trip is the first convenience store to offer a PHA-approved combo meal.

“Kwik Trip has made many advancements over the past two years to make healthier choices more convenient and accessible for our guests,” said Erica Flint, registered dietitian for Kwik Trip. “We have enjoyed working with PHA and receiving the positive feedback from guests on the programs we have implemented. We are eager to continue our partnership with PHA and get to work on our expanded commitments.”

Building upon these efforts as a part of its new commitment to PHA, by June 2017 Kwik Trip will offer an expanded stock of healthier options, including healthier packaged foods like nuts and granola bars throughout the store, and will increase healthier options in the checkout area. In addition, Kwik Trip will continue to encourage more consumers to drink water more often through its support of PHA’s Drink Up initiative.

From Sheetz on the East Coast to Kwik Trip in the Midwest to Loop stores in California, convenience stores have taken note of consumer demand for healthier options. Recognized as innovators in the foodservice industry, these stores and others, including U-Gas and Twice Daily, have teamed up with the Partnership for a Healthier America (PHA) to offer healthier options like fresh-cut fruits and vegetables, nonfat and low-fat dairy products and whole grain items; and they’re promoting those healthier products through marketing efforts in the store and at the pump.

And through the NACS reFresh initiative, convenience retailers are discovering new ideas that enhance their operations and communication efforts to showcase the industry’s positive business practices with the public, media and policymakers. Partnerships with groups such as PHA that share similar values are fostering best practices and making a difference.

http://www.nacsonline.com/Media/Daily/Pages/ND0222161.aspx#.VstUyPkrLRY

backOffice™ Software from Insight Retail Software will handle your c-Store healthier options beautifully! Do Better with InsightRS.