Guess what customers are saying about your stores? Some of the answers surprised even us

By Abbey Lewis, Editor in Chief, Convenience Store Products , Feb. 2, 2016

Illustration by Jean Jullien

From behind the two-way mirror, we exchanged glances—we were perplexed, surprised, amazed. A colleague and I sat with our notebooks in the dark, prepared to hear a lot of things we already knew: Customers like variety, fresh food, clean bathrooms, etc. But when our two focus groups arrived at Product Evaluations Inc.’s offices in Oak Brook, Ill., we heard a lot of things we weren’t expecting. Did you know they don’t consider convenience stores and gas stations to be the same thing?

Product Evaluations, a foodservice market research company, usually focuses only on food. Its expertise is on your roller grill or coffee bar. But for us the company bent the rules, focusing the line of questioning on the forecourt, backcourt and new products—and, of course, foodservice.

When we began developing the questions, we realized this could be a unique opportunity to truly discern between millennial customers and all the others. So we broke them into two groups. The first group was made up mostly of Gen X shoppers, with some baby boomers. The second group was composed entirely of millennial customers.

It’s worth mentioning all panel participants are from the Chicago area, which is flush with 7-Eleven, Speedway, BP, Thorntons and independent locations. None of our participants had even heard of Wawa, much less Rutter’s, Kwik Trip or Stripes. (Maybe next year we’ll conduct a panel from Florida and see what they think …)

Read on to see the differences and surprising similarities among respondents—as well as actionable tips based on their feedback. And keep an eye out at CStoreProductsOnline.com to read some of the outtakes.

> Consumer Loyalty Programs <

MILLENNIAL

Q: What makes you loyal to a particular convenience store?

Liz (Household income <$25,000): I look for a rewards program. I have one that’s an app on your phone and you can get free coffees and different free things. … I know if I get something, I’m going to get something free next time. It’s easier on my wallet. 7-Eleven had free coffee for the entire week recently, so I was there a lot. I went out of my way to get to that.

Q: Who has used rewards cards? Does it make you more loyal to those brands?

Mary ($75,000-$99,999): Yeah, at Speedway if you say you don’t have [your card], half the time they’ll just scan a new one for you. They pass them out like candy.

Tom ($100,000 or more): Yeah, they have bonus points that you buy like, say you buy a Red Bull, you get a hundred more extra points or something like that [at Speedway].

David ($100,000 or more): You buy three pieces of pizza instead of two, you get a bunch of extra points …

Convenience Store Products: So do they “get you” on that?

David: Oh yeah, I’m a sucker for that.

Big Idea

Liz: When I go to get scratch-offs, I always go to the CITGO in Glenwood, Ill., because they have all the machines right next to each other. They also have an area where you can sit down and scratch them off. It’s much better than other places.

GENERAL POPULATION

Q: What are you purchasing when you go to the convenience store?

Lorraine ($25,000-$39,000): When I go to a c-store … I might get some feminine products. I don’t want to necessarily go through the hassle of going to Wal-Mart, standing in line, going to search for it. The convenience store has got your drinks over here, you got your other stuff over here, you go, “OK, let me just grab it real quick and go.” The big stores, you have to deal with people, the crowd, and you got to really search. You ain’t got time for that.

Catherine ($100,000 or more): I usually just go there for drinks, like AriZona tea, or just a bag of chips and then go.

David ($100,000 or more): Beer, lottery tickets, scratch-offs—that’s probably it for that.

Do This!

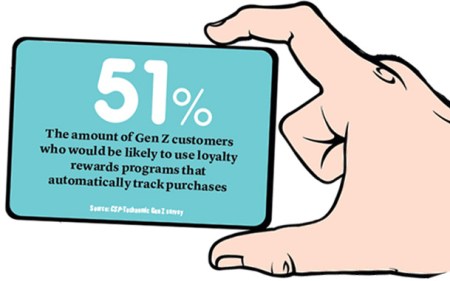

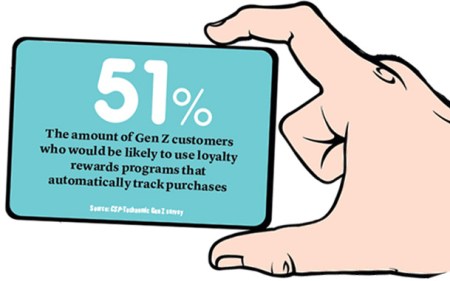

Mobile payment, souped-up loyalty programs, at-pump ordering, connected cooking equipment and more can greatly affect your foodservice program. According to an NCR study from earlier this year, 67% of restaurant owners and managers said that technology has a direct effect on increased revenue, and 35% are more dependent on tech tools than they were a year ago. Just remember to do your due diligence. Don’t invest in something your customers won’t use.

> New-Product Strategy <

GENERAL POPULATION

Q: How often do you go into the convenience store vs. just staying out at the pumps for gas?

Liz (Household income <$25,000): Most of the time I go inside.

Peter ($25,000-$39,000): I always go inside. When I’m not getting gas at Costco because it’s cheaper, whenever I stop at one of those stations, I always go inside. If I stop at one of those stations to get gas, it’s because I’m almost empty.

Jane ($40,000-$74,999): If I’m at the pump, and it’s at a convenience store, I always go in. Not that I need to go in. I don’t know why. I want to look at something. And I don’t pay at the pump.

Anne ($40,000-$74,999): Even with your credit card. Just go in. You just got to go in.

Convenience Store Products: You say you don’t ever pay at the pump?

Peter: I don’t because of security reasons. … I’ve heard so many things. I always go inside and pay, even if I want to swipe my card—I just don’t swipe it at the pump.

35%

The amount of gas customers who also go inside the store —2015 NACS Consumer Fuels Survey

Q: What piques your interest when you walk in a store? What will catch your eye?

Peter: Sometimes a display. What’s in front of your face—sometimes it’s a new product.

Anne: You know when you were a kid in a candy store, you see something at that display and you think, “Let’s go check that out.”

Peter: New Gatorade just came out. New flavors. Oh, that looks good. I’ll just take it.

MILLENNIAL

Q: What makes convenience stores unique from other kinds of stores?

Catherine ($100,000 or more): No lines.

David ($100,000 or more): In and out—it’s quick.

Lorraine ($25,000-$39,000): Everything is conveniently placed, so it’s not a whole search through a maze. Most of the aisles are open, so that when you’re walking through diagonally, you can see most of the things as you’re going. The setup is more open than a regular store.

Tom ($100,000 or more): Everything is accessible—easy to find.

“I’ll be out at lunch, and I don’t want to be at work, so I’ll find the gas station, go in there, look around, take my time, find something to snack on, then go back to work.” —Liz (<$25,000)

Do This!

New products matter! Work on developing your new-product strategy, but first strengthen Your core offer. Implement the proper analytics to measure your core products before investing in too many new-product tests. Of course, consistency could be the key—your customers are coming to you to find new products and will go to the same area or merchandiser to find them each time. Develop a plan and stick to it.

> Store Atmosphere <

MILLENNIAL

Q: How do you choose one store over the other?

Amanda (Household income $40,000-$74,999): I judge it on the size of the gas station. If I’m driving around or on a road trip, I’m going to hit the gas station that’s the biggest if I’m looking for snacks. I’m not going to go into, like, a little square shop …

Convenience Store Products: Why wouldn’t you go into the little place?

Amanda: Because then I feel like there’s less selection. If I’m going there specifically for food or whatever, I’m going to look for the biggest one. Even for a bathroom, I look for the biggest one because it means it won’t be outside.

Q: What do you buy at convenience stores?

Jenna: I remember when those Cheetos things came out, with all like the weird balls and everything, and I was like, oh my God, that’s going to be amazing. I was looking for them and I figured the gas stations would have it, so that’s when I was just knocking down the door. I finally found them.

57%

The amount of convenience stores (127,588 total) that sell motor fuels —NACSonline.com

GENERAL POPULATION

Q: What does the size of the store mean to you?

Peter ($25,000-$39,000): The small ones—it’s too cramped in there. There’s too many people in there. And it’s not just the inside, but the outside also. When you’re pulling up to this huge place, where there’s 10, 12 pumps and a big parking lot … with good lights.

Jane ($40,000-$74,999): Yes, you want the good lighting. It would be a safety issue.

Jack ($100,000 or more): A cramped place doesn’t feel as safe.

Jane: I will bypass those [small stores]. I’ll go to a bigger one. I would definitely go there before I’d go to a smaller one—it’s just safer.

Big Idea

Patty ($40,000-$74,999): What they need is oatmeal. Everyone else has oatmeal. I want oatmeal. It would be perfect for a convenience store—definitely.

Do This!

Surprisingly, both demographics differentiated between “gas stations” and “convenience stores.” To explain, Liz said, “I feel like the size is what distinguishes it. If it’s a really small building, then we feel like it’s just a gas station, nothing special. If it’s a bigger-size building and there’s more square footage, then it’s more of a convenience store.” Installing brighter lights and decluttering could go a long way toward attracting that new customer, boomers and millennials alike.

> Foodservice <

GENERAL POPULATION

Q: What’s your favorite food to buy at convenience stores?

Lorraine (Household income $25,000-$39,000): Pizza. You’re not expecting to get a supreme pizza—like, it’s going to be your most basic pepperoni, sausage or cheese.

David ($100,000 or more): I’m one of the least pickiest eaters out there, so it’s like I’ll get a Speedy Dog, and just load it up with all the ingredients, and I’ll go to town and I will love it. I’ll get their pizza and I’ll love it. That’s just me.

3 in 4

The number of shoppers who say it’s important to feel good about the foods and beverages they consume —Technomic’s Consumer Trend Report

Q: Which foods belong in convenience stores, and which do not?

Convenience Store Products: OK, so you’ve indicated that these items don’t fit at all: deli salads; chicken, either fried, roasted or grilled; soup, chili, dispensed ice cream or frozen yogurt.

Jenna (<$25,000): Where are you cooking the chicken?

Convenience Store Products: What about ice cream, soup or chili?

Amanda ($40,000-$74,999): I haven’t seen those.

David: Yeah, me neither.

Catherine ($100,000 or more): I think it’d be hard to keep the frozen-yogurt machine clean, but I’d totally get it.

MILLENNIAL

Q: How have your perceptions of convenience-store food changed?

David: Before, I always just assumed that it wasn’t good, that it wouldn’t taste good—I don’t know. … Once it became convenient to where I was working, and it was easy, convenient to get food there, I tried it. I said, “What the heck? Let’s do it.” And it tastes good. Let’s do it again.

Amanda ($40,000-$74,999): I feel exactly the same. I always thought it was just disgusting, and people might sneeze on it or something, but then it’s like, my guy would have me go pick up a pizza or something. Okay. And then I’m like, “Oh, it’s not that bad.” Then I ended up getting a few things for myself after that.

Tom ($100,000 or more): I felt like coffee was really bad at convenience stores, but I actually found out that at 7-Eleven, their coffee is much better than I thought.

“A large Slurpee from 7-Eleven—at 2 a.m., every time I was studying … we’d all go. It was awesome. And they go great with those little taquito things.” —Jenna

Do This!

These customers have changed their view of the food in your stores. Believe it or not, as much as perception of c-store fare has improved, there are still opportunities to be had. And freshness is the key. According to Technomic, 76% of consumers say positive terms such as “natural flavors” are perceived as resulting in enhanced flavors. And shoppers are demanding more transparency in their food. Non-GMO-fed, verified fresh eggs, chicken, pork and even sausages from brands such as Fork in the Road will be worth watching. Try it. They might like it!

http://www.cstoreproductsonline.com/foodservice/opinion-consumer-perspective

This slideshow requires JavaScript.

Posted by InsightRS

Posted by InsightRS

About

About